Latest Updates - Corona Virus - 24 Nov 2024

The Permissibility of Paying Zakah in advance due to Coronavirus pandemic - Covid 19

10 April 2020

The Permissibility of Paying Zakah in advance due to Coronavirus pandemic - Covid 19 All praise be to Allah, peace and blessings be upon the messenger of Allah, his family and his companions.

It was reported by Imam Ahmad, Abu Dawaud, Tirmizi, Ibnu Majah, Al-Hakim and others that, on the authority of Ali RA, Ibnu Abbas asked Prophet Muhammad PBUH regarding paying Zakah before its fixed time and He permitted it.

This Hadeeth was authenticated by some scholars and classifies as sound by others.

Also, it was reported by At-Tirmizi from the Hadeeth of Ali RA, that Prophet PBUH told Umar RA that, ((We have taken this year's Zakat from Al-Abbas in the previous year)). Imam At-Tirmizi RA said: ((And majority people of knowledge are of the opinion of the permissibility of paying Zakah in advance)).

Paying Zakah before its due time for a greater need and benefit such as emergency financial need for Muslims or any other calamities and pandemic was permitted by the majority Imams of Islam such as Abu Hanifah, Ash-hafi'e and Ahmad.

This is, of course, for someone who posses the Nisaab/Zakatable asset.

Based on the evidences mentioned above and due the necessity of preserving the human souls, it will be permissible to pay Zakah before its due time with the condition of having Nisaab/Zakatable asset at the time of paying Zakah. This verdict of permissibility has been issued due to the current difficult situation and immense suffering caused by pandemic "Covid 19" which has affected people of the whole entire world financially, socially, spiritually and many other ways. May Allah show his mercy to his slaves and remove this difficulty from the people of the world.

Translated by Sh. Kazi Lutfurahman.

Islamic Cultural Centre and London Central Mosque

The Permissibility of Paying Zakah in advance due to Coronavirus pandemic - Covid 19 All praise be to Allah, peace and blessings be upon the messenger of Allah, his family and his companions.

It was reported by Imam Ahmad, Abu Dawaud, Tirmizi, Ibnu Majah, Al-Hakim and others that, on the authority of Ali RA, Ibnu Abbas asked Prophet Muhammad PBUH regarding paying Zakah before its fixed time and He permitted it.

This Hadeeth was authenticated by some scholars and classifies as sound by others.

Also, it was reported by At-Tirmizi from the Hadeeth of Ali RA, that Prophet PBUH told Umar RA that, ((We have taken this year's Zakat from Al-Abbas in the previous year)). Imam At-Tirmizi RA said: ((And majority people of knowledge are of the opinion of the permissibility of paying Zakah in advance)).

Paying Zakah before its due time for a greater need and benefit such as emergency financial need for Muslims or any other calamities and pandemic was permitted by the majority Imams of Islam such as Abu Hanifah, Ash-hafi'e and Ahmad.

This is, of course, for someone who posses the Nisaab/Zakatable asset.

Based on the evidences mentioned above and due the necessity of preserving the human souls, it will be permissible to pay Zakah before its due time with the condition of having Nisaab/Zakatable asset at the time of paying Zakah. This verdict of permissibility has been issued due to the current difficult situation and immense suffering caused by pandemic "Covid 19" which has affected people of the whole entire world financially, socially, spiritually and many other ways. May Allah show his mercy to his slaves and remove this difficulty from the people of the world.

Translated by Sh. Kazi Lutfurahman.

Islamic Cultural Centre and London Central Mosque

Donate > Zakat

Zakat is not just a duty on those with wealth, but a right that the poor have over us - we are "those in whose wealth there is a recognised right for the needy and the poor" (Qur'an 70:24-25).

The London Central Mosque Trust uses your zakat in the most effective way possible to relieve the suffering of the most vulnerable people.

Zakat is a mandatory duty on all able Muslims who meet nisab values. There is no ambiguity as to the rate at which Zakat should be calculated; 2.5% of all net savings one possesses that is above the nisab value. Net savings is total maintained wealth for one lunar year before Zakat is due.

The London Central Mosque Trust uses your zakat in the most effective way possible to relieve the suffering of the most vulnerable people.

Zakat is a mandatory duty on all able Muslims who meet nisab values. There is no ambiguity as to the rate at which Zakat should be calculated; 2.5% of all net savings one possesses that is above the nisab value. Net savings is total maintained wealth for one lunar year before Zakat is due.

Online Payment

Mosque Updates >>

Updates Regarding Ramadan and Mosque Activities

The Permissibility of Paying Zakah in advance due to Coronavirus pandemic - Covid 19 >>

Prophet Muhammads guidance for the Prevention of and Protection from Disease and Epidemics by Dr Naji Ibrahim >>

Introduction to Fasting - Dr Khalifa Ezzat >>

Ramadan and Zakah [Giving Charity] >>

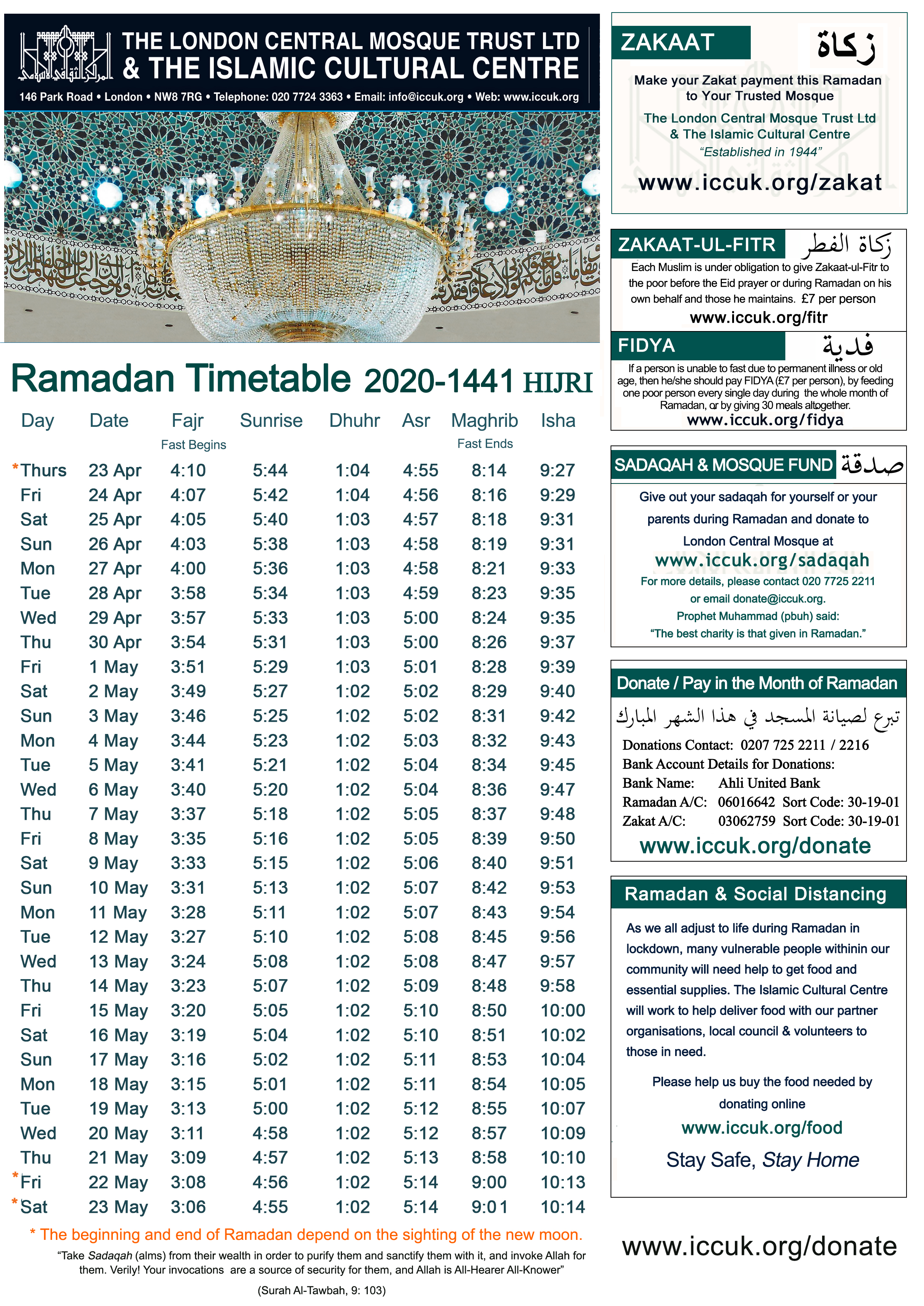

Ramadan Timetable 2020 >>

Welcoming Ramadan - Sermon by Dr. Khalifa Ezzat >>

What is the Night of Determination [Qadr]? >>

Donate Online

Donate Zakat for Food during Pandemic >>

Donate Online >>

Advice Regarding Burial of the Deceased

Washing and Burying the Deceased during the Pandemic Disease >>

Statement and Guidance relating to Burial of the deceased - by The Lord Sheikh >>

Lord Sheikh on the Coronavirus Bill in the House of Lords >>

Government & Stakeholder Advice

GOV UK Guidelines with Question & Answers >>

NHS Advice for Communities >>

Public Health England - Guidance on social distancing in UK >>