Latest Updates - Corona Virus - 26 Apr 2024

Ramadan and Zakah [Giving Charity]

11 April 2020

Ramadan is the month of generosity; giving charity and benevolence. It is the month of solidarity, kindness and mercy. Ibn ‘Abbas narrated that the Messenger of God [pbuh] was the most generous person and he would be at his most generous in Ramadan because Jibrīl would come to him every night and he would rehearse the Qur’an with him; he did so twice in the year of his death.’ [al-Bukhari] The best charity, the best Zakah and the best Sadaqah to be given is that given during the month of Ramadan. Feeding the poor and needy of fasting people is highly recommended in Ramadan. The Prophet [pbuh] said, ‘Whoever feeds a fasting person will get a reward like him’ [Ahmad]. He also said, ‘protect yourself from the fire even by giving half of a date’ [Agreed upon].

In the Qur'an there are five words used for charity: Zakah [obligatory charity], Ṣadaqah [charity], khairāt [good deeds], ihsān [kindness and consideration], infāq fi sabil God [spending for the sake of God]. They all aim to elevate the human personality by removing selfishness, greed and materialism. It creates compassion, care, love and kindness. They make a person more thankful to God. Charity helps those who are in need and it provides funds for good causes and community projects. There are three types of Zakah [Charity]:

1. Annual Zakah,

2. Zakat al-Fiṭr or Ṣadaqah al-Fiṭr [Charity of Breaking Fasting]

3. Ṣadaqah Tatawu' [optional charity].

Some people are confused about these types of Zakah and Ṣadaqah. What is the difference between the three types?

1. Annual Zakah: One of the five pillars of Islam and is a duty performed on a regular basis. Zakah is a compulsory payment and is neither a charity nor a tax. Zakat benefits the giver as well as the receiver. It is a contribution paid once a year on savings of % 2.5. It is paid on the net balance after a Muslim has spent on basic necessities, family expenses, due credits, donations and taxes. The aim is to purify your wealth and possessions from excessive desire for them or greed. It also aims to purify the heart of the wealthy from stinginess and the heart of the poor from envy and hatred. It is expected from every Muslim individual. Assets to include in your Zakat calculation are cash [in bank accounts or on hand], gold, silver, shares, pensions, business goods, crops and cattle. You do not have to count personal items such as your home, furniture, cars, food, clothing, which are not used for business purposes.

2. Zakat al-Fiṭr or Ṣadaqah al-Fiṭr [Charity of Breaking Fasting]: A special charity for the month of Ramadan. Every free Muslim must pay Zakat al-Fiṭr for himself, his wife, children and servants. The amount of Zakat al-Fiṭr was fixed by the Prophet [pbuh]. It is about a Sa‘ [approximately 2.6 – 3kg] of wheat, flour, barley, dates or raisins, or equivalent in cash, to the poor and needy. Cash might be better and more beneficial nowadays. This charity aims to help the poor and needy in the month of Ramadan and to celebrate Eid with other Muslims. The second aim is to expiate [Kaffārah] for any mistakes or wrongdoings a person may have done during this blessed month.

3. Ṣadaqah Tatawu' [optional charity]: Can be paid at any time to any poor person, including non-Muslims. A Muslim will be rewarded if he gives this type of charity but will not be blamed if he does not.

Who Is Eligible for Charity?

Eight categories of people are entitled to Zakah:

1. Poor,

2. Needy,

3. Those who administer the Zakah,

4. Those whose hearts are reconciled for Islam [new Muslims etc.],

5. To free the slaves,

6. Those unable to pay their debts,

7. Travellers rendered helpless, and In the Way of God.

These categories are mentioned in the Qur'an in Surah At-Tawbah verse number 60. God the Almighty says, "Zakah expenditures are only for the poor and for the needy and for those employed to collect [Zakah] and for bringing hearts together [for Islam] and for freeing captives [or slaves] and for those in debt and for the cause of God and for the [stranded] traveller - an obligation [imposed] by God. And God is Knowing and Wise" [9:60].

Is it Allowed to Pay Zakah in Advance because of Coronavirus and Other Calamities?

Because of the current challenging times and difficulties that the world face and disruption of the activities, the majority of scholars agreed that giving Zakah in advance is permissible and even recommended at the time of need and necessity.

Paying Zakah and giving charity in advance before the its due times is even recommended at the time of calamities, pandemic diseases, or emergency financial need. Prophet Muhammad [pbuh] allowed Al-Abbas to give Zakah in advance.' [Ibn Majah and Al-Timidhi]

Therefore, Muslims can give their Zakah before its due time to the needy and poor and those who have no sources of income during coronavirus. They can also send it abroad if there are no needy or poor people where they live.

Sh. Khalifa Ezzat

Chief Imam and Head of Religious Affairs

Ramadan is the month of generosity; giving charity and benevolence. It is the month of solidarity, kindness and mercy. Ibn ‘Abbas narrated that the Messenger of God [pbuh] was the most generous person and he would be at his most generous in Ramadan because Jibrīl would come to him every night and he would rehearse the Qur’an with him; he did so twice in the year of his death.’ [al-Bukhari] The best charity, the best Zakah and the best Sadaqah to be given is that given during the month of Ramadan. Feeding the poor and needy of fasting people is highly recommended in Ramadan. The Prophet [pbuh] said, ‘Whoever feeds a fasting person will get a reward like him’ [Ahmad]. He also said, ‘protect yourself from the fire even by giving half of a date’ [Agreed upon].

In the Qur'an there are five words used for charity: Zakah [obligatory charity], Ṣadaqah [charity], khairāt [good deeds], ihsān [kindness and consideration], infāq fi sabil God [spending for the sake of God]. They all aim to elevate the human personality by removing selfishness, greed and materialism. It creates compassion, care, love and kindness. They make a person more thankful to God. Charity helps those who are in need and it provides funds for good causes and community projects. There are three types of Zakah [Charity]:

1. Annual Zakah,

2. Zakat al-Fiṭr or Ṣadaqah al-Fiṭr [Charity of Breaking Fasting]

3. Ṣadaqah Tatawu' [optional charity].

Some people are confused about these types of Zakah and Ṣadaqah. What is the difference between the three types?

1. Annual Zakah: One of the five pillars of Islam and is a duty performed on a regular basis. Zakah is a compulsory payment and is neither a charity nor a tax. Zakat benefits the giver as well as the receiver. It is a contribution paid once a year on savings of % 2.5. It is paid on the net balance after a Muslim has spent on basic necessities, family expenses, due credits, donations and taxes. The aim is to purify your wealth and possessions from excessive desire for them or greed. It also aims to purify the heart of the wealthy from stinginess and the heart of the poor from envy and hatred. It is expected from every Muslim individual. Assets to include in your Zakat calculation are cash [in bank accounts or on hand], gold, silver, shares, pensions, business goods, crops and cattle. You do not have to count personal items such as your home, furniture, cars, food, clothing, which are not used for business purposes.

2. Zakat al-Fiṭr or Ṣadaqah al-Fiṭr [Charity of Breaking Fasting]: A special charity for the month of Ramadan. Every free Muslim must pay Zakat al-Fiṭr for himself, his wife, children and servants. The amount of Zakat al-Fiṭr was fixed by the Prophet [pbuh]. It is about a Sa‘ [approximately 2.6 – 3kg] of wheat, flour, barley, dates or raisins, or equivalent in cash, to the poor and needy. Cash might be better and more beneficial nowadays. This charity aims to help the poor and needy in the month of Ramadan and to celebrate Eid with other Muslims. The second aim is to expiate [Kaffārah] for any mistakes or wrongdoings a person may have done during this blessed month.

3. Ṣadaqah Tatawu' [optional charity]: Can be paid at any time to any poor person, including non-Muslims. A Muslim will be rewarded if he gives this type of charity but will not be blamed if he does not.

Who Is Eligible for Charity?

Eight categories of people are entitled to Zakah:

1. Poor,

2. Needy,

3. Those who administer the Zakah,

4. Those whose hearts are reconciled for Islam [new Muslims etc.],

5. To free the slaves,

6. Those unable to pay their debts,

7. Travellers rendered helpless, and In the Way of God.

These categories are mentioned in the Qur'an in Surah At-Tawbah verse number 60. God the Almighty says, "Zakah expenditures are only for the poor and for the needy and for those employed to collect [Zakah] and for bringing hearts together [for Islam] and for freeing captives [or slaves] and for those in debt and for the cause of God and for the [stranded] traveller - an obligation [imposed] by God. And God is Knowing and Wise" [9:60].

Is it Allowed to Pay Zakah in Advance because of Coronavirus and Other Calamities?

Because of the current challenging times and difficulties that the world face and disruption of the activities, the majority of scholars agreed that giving Zakah in advance is permissible and even recommended at the time of need and necessity.

Paying Zakah and giving charity in advance before the its due times is even recommended at the time of calamities, pandemic diseases, or emergency financial need. Prophet Muhammad [pbuh] allowed Al-Abbas to give Zakah in advance.' [Ibn Majah and Al-Timidhi]

Therefore, Muslims can give their Zakah before its due time to the needy and poor and those who have no sources of income during coronavirus. They can also send it abroad if there are no needy or poor people where they live.

Sh. Khalifa Ezzat

Chief Imam and Head of Religious Affairs

Donate > Zakat

Zakat is not just a duty on those with wealth, but a right that the poor have over us - we are "those in whose wealth there is a recognised right for the needy and the poor" (Qur'an 70:24-25).

The London Central Mosque Trust uses your zakat in the most effective way possible to relieve the suffering of the most vulnerable people.

Zakat is a mandatory duty on all able Muslims who meet nisab values. There is no ambiguity as to the rate at which Zakat should be calculated; 2.5% of all net savings one possesses that is above the nisab value. Net savings is total maintained wealth for one lunar year before Zakat is due.

The London Central Mosque Trust uses your zakat in the most effective way possible to relieve the suffering of the most vulnerable people.

Zakat is a mandatory duty on all able Muslims who meet nisab values. There is no ambiguity as to the rate at which Zakat should be calculated; 2.5% of all net savings one possesses that is above the nisab value. Net savings is total maintained wealth for one lunar year before Zakat is due.

Online Payment

Mosque Updates >>

Updates Regarding Ramadan and Mosque Activities

The Permissibility of Paying Zakah in advance due to Coronavirus pandemic - Covid 19 >>

Prophet Muhammads guidance for the Prevention of and Protection from Disease and Epidemics by Dr Naji Ibrahim >>

Introduction to Fasting - Dr Khalifa Ezzat >>

Ramadan and Zakah [Giving Charity] >>

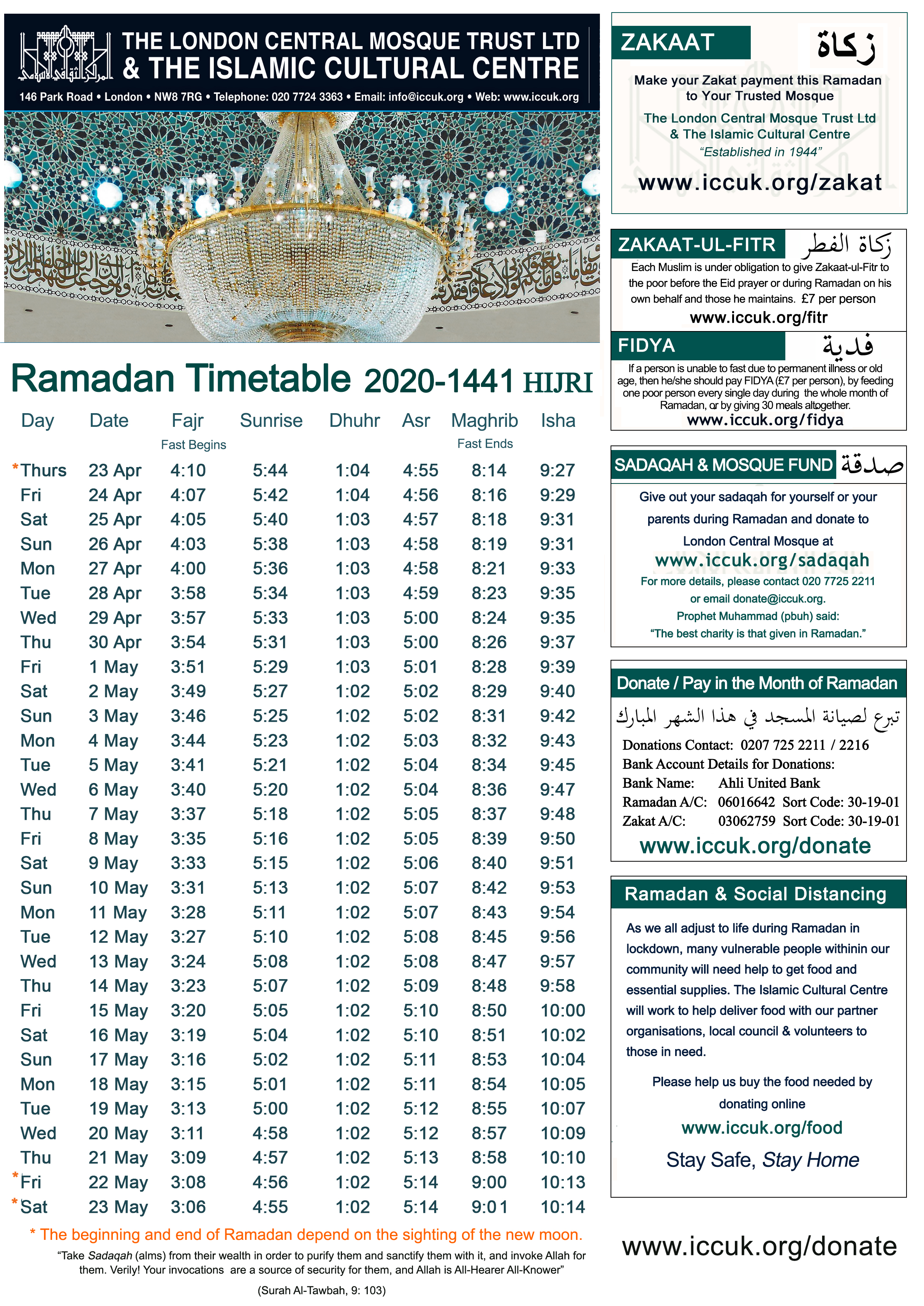

Ramadan Timetable 2020 >>

Welcoming Ramadan - Sermon by Dr. Khalifa Ezzat >>

What is the Night of Determination [Qadr]? >>

Donate Online

Donate Zakat for Food during Pandemic >>

Donate Online >>

Advice Regarding Burial of the Deceased

Washing and Burying the Deceased during the Pandemic Disease >>

Statement and Guidance relating to Burial of the deceased - by The Lord Sheikh >>

Lord Sheikh on the Coronavirus Bill in the House of Lords >>

Government & Stakeholder Advice

GOV UK Guidelines with Question & Answers >>

NHS Advice for Communities >>

Public Health England - Guidance on social distancing in UK >>